Moremonee, Nigeria's leading fintech, has again taken the lead in innovation with the launch of Snappy, Africa's first-ever snap payment feature.

Nigeria’s leading financial service provider Moremonee has rapidly evolved since its establishment in 2008, securing its Central Bank of Nigeria (CBN) license in July of that year.

In a significant development, Moremonee was acquired by Moremonee Limited in October 2023, marking the start of a new era for the financial service provider.

With a bold vision to become Africa’s generational bank, Moremonee aims to tackle poverty across the continent by offering accessible financial services that empower business owners and foster job creation.

The company is committed to driving growth through innovative products, seamless transactions, and strategic technological integration.

At the heart of Moremonee’s offerings is its intuitive online banking app, which enables users to perform a wide array of financial tasks with ease.

Customers can send and receive funds, earn daily interest, shop online, pay bills, and even fund their bet wallets—all from the convenience of their smartphones. With an emphasis on speed and security, transactions are executed instantly, ensuring that funds are transferred without delay.

In addition to traditional banking features, Moremonee stands out with unique services such as target savings, where users can lock funds and earn interest, and a versatile account management system that allows customers to operate business, family, and personal accounts from a single dashboard. The app also offers a marketplace feature, enabling entrepreneurs and small business owners to advertise their products and services, expanding their reach to a broader customer base.

As a trailblazer in the financial industry, Moremonee continues to push the boundaries of innovation, and its latest collaboration is no exception.

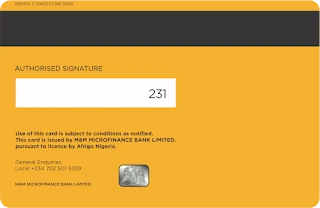

In partnership with NIBSS, Nigeria’s leading provider of electronic payment and settlement infrastructure, Moremonee M&M MFB is ensuring seamless integration of the AfriGO card into the national payment system. This collaboration will enable efficient, streamlined transactions within Nigeria’s domestic economy.

The AfriGO card, launched as part of the Central Bank of Nigeria’s (CBN) initiative, is designed to strengthen domestic transactions, decreasing reliance on international payment systems while fostering greater financial inclusion across the country.

Moremonee’s partnership with NIBSS and the AfriGO project supports the Central Bank of Nigeria’s (CBN) goal to improve the country’s financial system. This move aims to reduce Nigeria’s reliance on foreign payment platforms and boost local financial stability. As the country’s main financial authority, the CBN has worked hard to promote steady growth, and Moremonee is excited to be a key part of this change.

By introducing the first-ever Nigerian domestic card, Moremonee is not only driving innovation but also contributing to the development of a secure, convenient, and affordable payment solution for Nigerians. This move is designed to benefit both consumers and businesses alike.

The AfriGO card offers multiple advantages, including enhanced security, cost-effective payment options, and increased financial access for underserved populations, ultimately reducing Nigeria’s reliance on foreign payment systems. This is expected to have a ripple effect on economic growth, enabling more Nigerians to join the formal financial sector and participate in the country’s economic transformation.

Under the leadership of Chairman Dr. Mohammed Nurudeen Olatunji, widely known as Dr. MO, Moremonee has rapidly risen to become one of the fastest-growing microfinance banks in Nigeria.

A cybersecurity expert and Chartered Fellow of Financial Management, Dr. MO has been instrumental in transforming the bank with cutting-edge ideas and a commitment to excellence. His leadership earned him the prestigious Nelson Mandela Leadership Award for Excellence and Integrity, and in 2021, he was honored with the Nigeria Most Respected CEO Award.

Dr. MO, a graduate of the University of Ilorin with a degree in Computer Science, has steered Moremonee toward remarkable achievements. Notably, the bank recently launched Nigeria’s first domestic ATM debit card, a collaboration with NIBSS and AfriGO. This card enables users to make withdrawals and online payments, marking a significant step forward in Nigeria’s digital payment infrastructure.

Moremonee’s commitment to user privacy and security sets it apart in an increasingly digital financial world.

The bank employs the latest technology to ensure that transactions are both fast and secure, protecting users’ personal and financial data.

Furthermore, Moremonee offers 24-hour customer support, ensuring that any questions or issues are promptly addressed by a dedicated team.

With a focus on technological innovation and customer-centric services, Moremonee continues to expand its impact.

In 2024, the bank sponsored the Calabar Biker Carnival to enhance brand visibility and foster community engagement. As Moremonee pushes forward with its mission to create a generational bank for Africa, the future of financial services in Nigeria and beyond looks brighter than ever.

The latest news, technologies, and resources from our team.